Say you’re in the market for new office space, and you think you need to rent about 5,000 square feet of commercial space. You may end up paying for 7,000 square feet. And that’s not because the landlord is overcharging: instead, the increased cost results from something called loss factor. Loss factor significantly impacts the amount of space you get and how much you’re paying for it.

All tenants should know what loss factor is, how it’s calculated, who decides how it’s calculated, and how it affects the search for suitable office space.

What is Loss Factor?

Simply put: loss factor—sometimes referred to as load factor or core factor—is office space square footage you pay for but cannot use. For example, you might be paying for the square footage that comprises the restroom or electrical closet. Though those are necessary spaces, you obviously can’t put desks or conference tables in there. Loss factor areas are sometimes also called “common area factors” or “add-on factors” because they include spaces that tenants share. Other examples include fire stairs, elevator lobby, parking garages, utility rooms, cafeterias, stairwells, lobby space, and rooftop terraces.

The average office building in New York City has a loss factor of around 27%. To find out how much legitimate, bona fide, you-can-set-up-an-employee square footage you have in a commercial space, you need to know how to calculate loss factor.

How Do You Calculate Loss Factor?

How can you figure out how much loss factor you’re signing up for when you are scouting commercial real estate? To answer that question, we must first define Rentable Square Footage (RSF) and Usable Square Footage (USF).

Commercial brokers and landlords will use two different numbers to describe the size of a space: Rentable Square Foot (RSF) and Usable Square Foot (USF).

- Rentable Square Footage: Rentable Square Footage is the measurement of the entire space the tenant leases from the landlord, even including useless spaces (such as areas filled by walls) and spaces shared with other tenants (like stairwells and bathrooms).

- Usable Square Footage: Usable Square Footage comprises the area of the commercial space a tenant—and only that tenant—can use for desks, conference tables, etc.

Mathematically, loss factor equals “the percentage difference between rentable area and usable area.” In other words, you can calculate loss factor by dividing the difference between the Rentable Square Footage (RSF) and the Usable Square Footage (USF) by the RSF.

Let’s go back to our example from the first paragraph and use the loss factor calculation formula do the math in three easy steps:

First, find the two essential numbers: Rentable Square Feet and Usable Square Feet.

- RSF: 7,000 square feet

- USF: 5,000 square feet

Second, subtract the Usable Square Footage from the Rentable Square Footage.

- 7,000 sf (RSF) – 5,000 sf (USF) = 2,000 sf

Third, divide the difference by the Rentable Square Footage.

- 2,000 sf ÷ 7,000 sf (RSF) = 28% loss factor

Voila. The loss factor for your commercial space is 28%. That means, you’re paying for 100% of the office space, but you are only able to actually use 72% of it. You can also think of it as a ratio—unusable space : total space—in this case, 28 : 100 (or 7 : 25).

Who Decides How Loss Factor is Calculated?

Calculating loss factor may seem relatively straightforward. However, consider that it is not calculated the same way in every case. It can vary depending on who measures it; sometimes a landlord will re-measure the square footage of a property to see if they can squeeze in more square feet—increasing the perceived value of their product. Also, depending on where you are in the United States, a different authority defines what constitutes RSF, USF, and loss factor. The two organizations most pertinent to the loss factor discussion are the Business Owners and Managers Association (BOMA) and the Real Estate Board of New York (REBNY).

- BOMA: Founded in 1907, BOMA’s “mission is to advance a vibrant commercial real estate industry through advocacy, influence, and knowledge,” according to the website. Landlords operating in most parts of the United States use BOMA standards to calculate commercial property square footage and thus loss factor percentages.

- REBNY: When REBNY was established in 1896, it became the state’s first real estate trade association. According to the organization’s website, its goals include “expanding New York’s economy, encouraging the development and renovation of commercial and residential property, enhancing the city’s appeal to investors and residents and facilitating property management.” New York City landlords use REBNY standards to calculate commercial real estate square footage and thus loss factor.

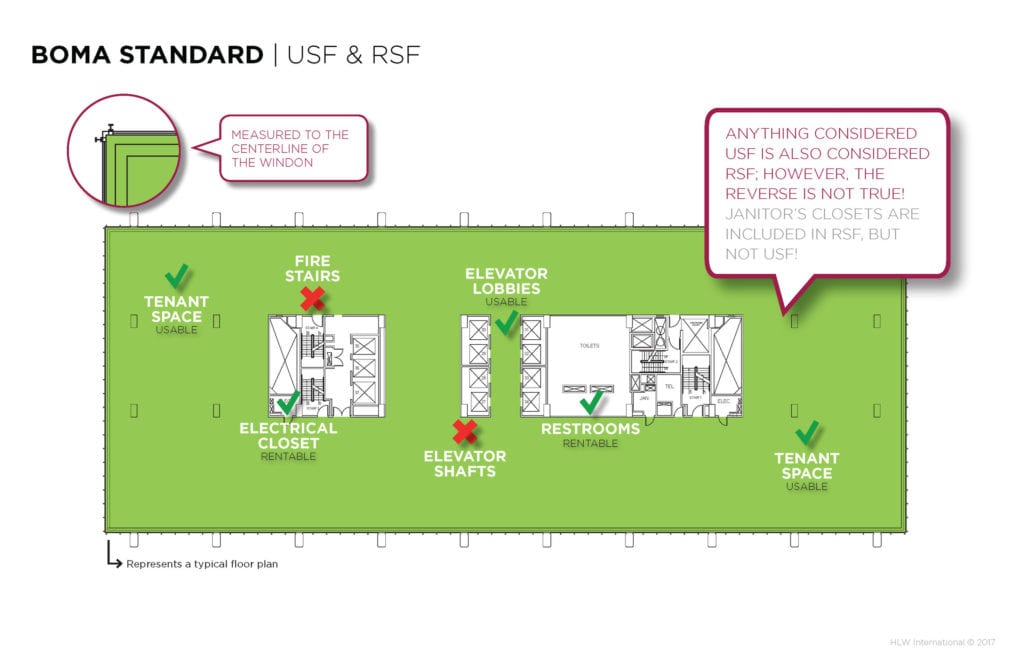

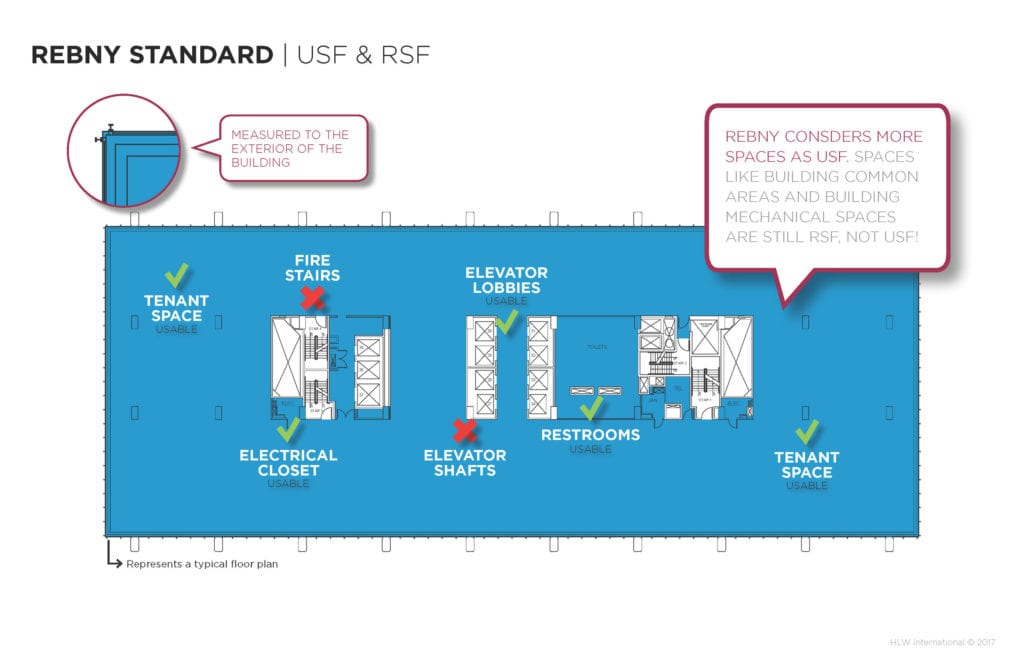

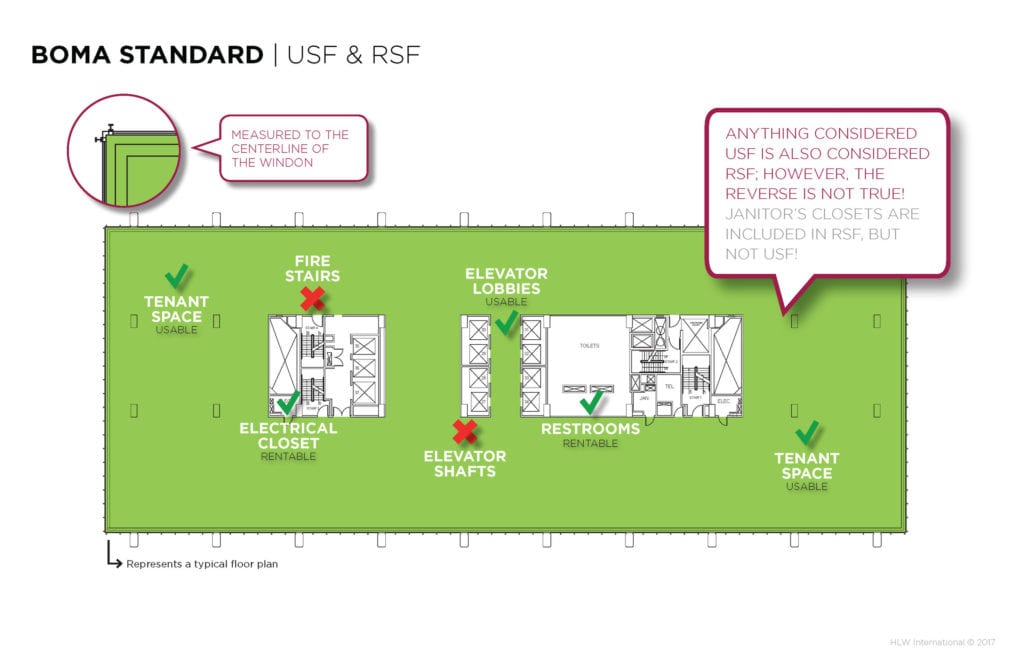

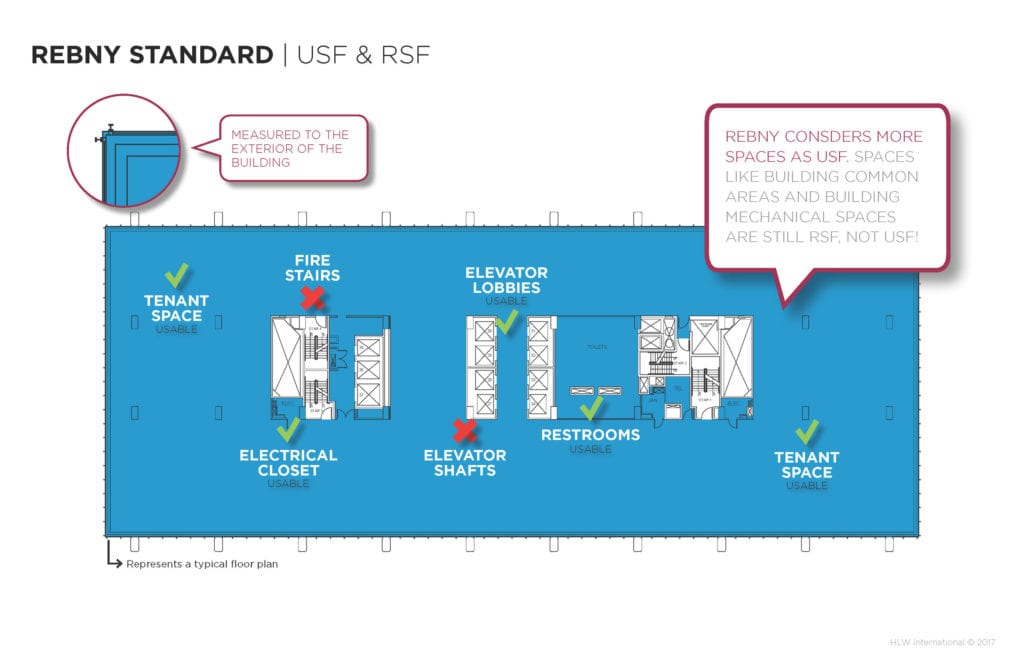

So what’s the difference in the way BOMA and REBNY calculate USF, RSF, and loss factor? The first main difference is that BOMA dictates that space measurements are taken from the centerline of the window, while REBNY standards state that space measurements are taken from the exterior of the building. Also, REBNY considers more spaces as USF than BOMA does. Examine the following two HLW International graphics for details:

Is Loss Factor Negotiable?

Now that you are aware of loss factor and have a general idea of how it’s calculated, it’s time to talk about how it is related to your search for commercial space. “I think it has become the norm for a quote [from the landlord] for retail square footage to have some loss factor,” said Robin Abrams, a retail broker for the commercial firm Lansco. “There is no absolute standard anymore.” If you’re going to negotiate loss factor, do it early. You don’t want to waste your time evaluating a property that is too expensive for your budget or doesn’t offer enough space for your business.

Negotiating against the landlord regarding what the loss factor is for any given building may be difficult. However, with the proper education and the right people on your side (like a tenant broker), it is possible to combat this difficult conundrum.

How to Reduce the Effects of Loss Factor

Loss factor is ubiquitous in commercial real estate. It’s an important issue for not only landlords and real estate brokers but also tenants. “Increasingly, top management teams realize that occupancy costs can no longer be ignored or passed on to lower-level managers,” Mahlon Apgar, IV writes for Harvard Business Review. “Organizations as diverse as Shearson, AT&T, Dun & Bradstreet, and USF&G have set up formal occupancy cost reduction programs.”

Here are ten ways to reduce the effects of loss factor:

- Recognize that average loss factor can change based on location and property style: If you’re looking at the loss factor for any given building and wondering how it measures up to similar spaces, remember that lots of factors are at play. First, the average loss factor varies based on location. For example, New York City tenants will see loss factors averaging 27%, while their New Jersey suburban neighbors might enjoy loss factors averaging only 18%.

- Recognize that average loss factor can change based on property style. Obviously, buildings with big, open lobbies and lots of stairwells, bathrooms, and shared spaces are going to have higher loss factors, while buildings with fewer common areas will have lower loss factors. Also, the number of tenants can make a difference. Dividing a property among many tenants may actually increase the loss factor.

- Comparison shop: Two commercial buildings in the same area that appear to be about the same size might have two entirely different RSF’s and loss factors. It’s important to look at multiple spaces and ask a lot of questions to make sure you get what you pay for.

- Realize you’ll need more square footage than you think: Perhaps you’ve used our office space calculator and determined that your company needs 5,000 square feet of office space. Keep in mind you may need to look at spaces that are advertised to have 6,000 square feet or more because those measurements also include space that’s shared or useless.

- Just ask for a better deal. Try negotiating the rent based on Usable Square Footage rather than Rentable Square Footage. Simply suggest using the Usable Square Footage as the basis for the rent agreement. It might sound like a long shot, but it’s worth a try.

- Ask for the total monthly rental cost: Most of the time, commercial real estate prices are presented as “per square foot” costs. Ask for or calculate the total monthly rental cost and weigh your options that way instead to avoid surprise extra charges associated with previously unrecognized useless space.

- Ask for the RSF to be specified in the lease: Now that you’ve seen building size isn’t exactly universal and objective, you should ensure the agreed-upon square footage is explicitly stated in your contract.

- Inquire about a renewal option: Space remeasurement—that is, a landlord’s measuring a space again for better accuracy or using different or updated standards—may increase the recognized RSF of any given space, which might mean a price increase for any current tenants. That’s right; your office building may actually increase in space without actually getting bigger. Putting together an airtight renewal option can protect a tenant from an unnecessary price increase upon potential lease renewal.

- Look at a layout prepared by an architect: Funny-shaped buildings can waste a lot of space, and the untrained eye might not recognize these “dead” spaces without some help. Ask to see a building layout prepared by an architect, and then you’ll be able to see for yourself how much of the building is comprised of usable space.

- Get a tenant broker: Navigating loss factor-related issues in commercial real estate can be daunting. For best results, get a tenant broker. Feel free to call us or email us; we are here to help. One of our experienced brokers will be happy to answer all your questions and help ensure you get the most out of the money you spend to rent office space.